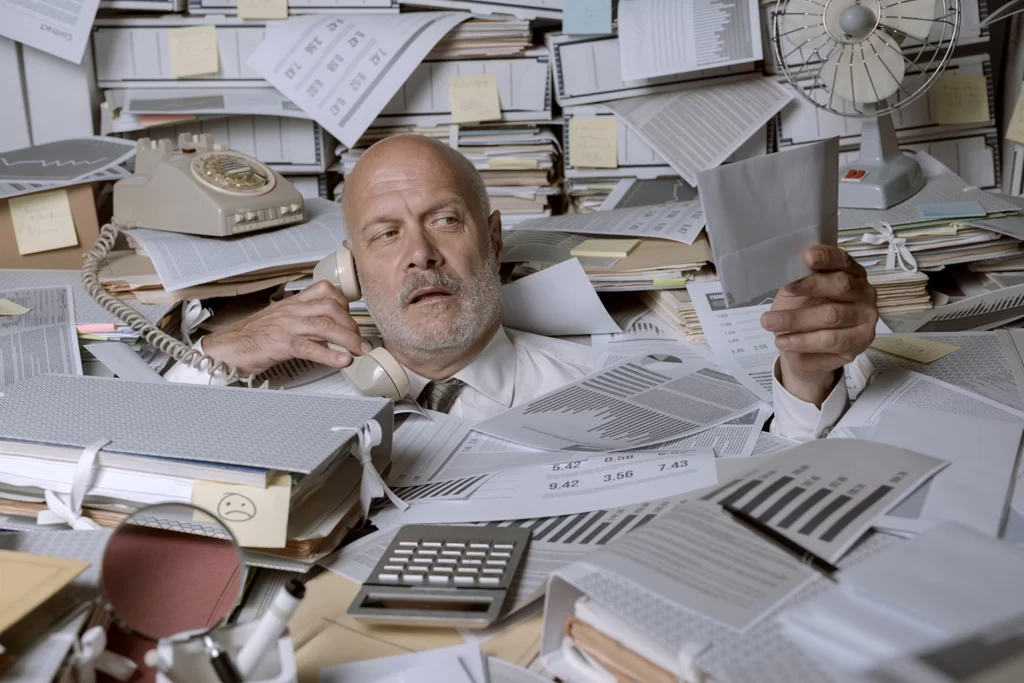

Self Assessment Tax Return the very words send shivers down the spines of most self-employed people, but it does not have to be all stress and worry! If this is your first time or your 50th time, we have some handy tips to make completing your self-assessment tax return a doddle!

Blog Contents:

showKnow Your Terminology

Whether you are hiring an accountant to complete your return or planning to do it yourself, knowing at least some of the terminology in your SATR will save you a lot of stress and confusion. You do not need to be an expert in all the different terms and acronyms, but knowing some high-level ones can help you, such as:

- Tax Year: This is between the 6th of April and the 5th of April the following year.

- Dividends: Any income taken from a limited company by a director as a dividend payment.

- Expenses: Any expenses incurred as a business such as materials, equipment or stationary.

Knowing a few key terms can help you understand what to expect and what to look out for in terms of possible errors or issues arising from or with your return.

Get Everything In Order

You should never start to complete your self-assessment tax return before ensuring that your accounts are up to date. Doing so could mean you are submitting it with outdated information, which could lead to an over or underpayment in tax. To ensure that your accounts are up to date, it is best to keep track of things either by using online bookkeeping software or by hiring a bookkeeper.

If you are not storing your details digitally, we would advise having a system such as keeping invoices and receipts with the corresponding bank statements, possibly in a folder or envelopes. They can then be easily found and accessed in time for completing your return.

Don’t Leave Things Till The Last Minute

We are all guilty of falling into that trap of thinking that there is loads of time left to do it, and it will only take 5 minutes. When dealing with HMRC, this could be a costly mistake. The fines for not submitting on-time start at an automatic £100 and increase with daily interest charges.

Getting everything ready ahead of time is the best practice. If you are working with an accountant, most will be asking for your details earlier than you might expect! So as mentioned above, having a system in place to make this much easier will save you time and save you a lot of money!

Summary

Of course, the easiest way to deal with all your self-assessment worries and tax issues is to work with an accountant all year round. Then your accounts are always up to date, and tax returns are filed on time. If you are looking for self-assessment help, bookkeeping services or complete accountancy packages, why not speak to us here at RJF Accounting? We have the team, the expertise and the passion for helping you get everything done and dusted and take all that stress away!